As a sustainability metric closely tied to a company’s financial success, “ESG” is definitely the last trend you want to miss. Apart from the fact that it is green-related, what else do you know about ESG? Why is ESG appealing to businesses and investors? Any examples of corporates doing ESG? This article is here to give you a more holistic view.

As we are entering the age of big data, data scientists are becoming a critical enterprise asset in almost every organization. Hoping to take your first step down the data scientist path? Good news to you, no matter your background, data science is one of the most dynamic fields to enter into. Let’s look deep into the life of a data scientist and what could be done to navigate a successful career change.

What is ESG?

“ESG” stands for “Environmental, Social and Governance”, which is a set of criteria used to evaluate a company’s non-financial performance.

The concept of ESG has grown exponentially over the past few years, but the concept goes back much further.

First coined in 2005, the term ESG made its first appearance in the Freshfields Report. The project team suggested that a company’s purpose should go beyond maximising profit, stating, “Quality of life and quality of the environment are worth something, even if not, or particularly because, they are not reducible to financial percentages.”

Although their initial thought was to promote ESG as “GES”, given that they believed the highest priority should be given to the Governance area, followed by Environmental and Social, the seeds of the idea were sown and triggered more ESG innovation and integration than ever before.

Reference: Investopedia, JDSUPRA

Read more:What’s an MBA/ EMBA? Learn About Types, Costs & RequirementsAll you need to know about start up business in Hong Kong

Why is it important?

ESG has been receiving increasing attention across the globe, and the reasons vary by business and investor.

From Business Perspective

By taking a “green” step, businesses can gain multi-faceted and all-permeable benefits:

1. Cost Reduction

The effective implementation of ESG strategies and practices can help save operating costs. According to McKinsey, ESG-friendly businesses can cut operating expenses such as raw-material costs and energy charges by up to 60%.

Consider Nestlé, which has decided to replace virgin plastic packaging with food-grade recycled plastics and other sustainable packaging solutions. Not only does it help to lower carbon emissions, but it also reduces the amount of plastic packaging tax that the company has to pay among different geographies.

2. Productivity Enhancement

It might be appealing to the HR departments since a strong ESG proposition is proven to be conducive to talent acquisition and workplace productivity.

According to Cone Communications on Millennial Employee Engagement, nearly 70% of Millennials want to work for an organisation committed to social and environmental values.

Recent studies have also discovered that positive social impact correlates with higher job satisfaction, and employees tend to react with enthusiasm in return.

3. Fewer Legal Intervention

It is noted that ESG can also help to ease regulatory pressure. McKinsey has found that companies with lower ESG scores are more likely to receive government punishment and community opposition, on the other hand, an ESG-oriented strategy helps to engender support from different sectors.

From Investor’s Perspective

ESG has also become Wall Street’s new favourite buzzword as the related assets are expected to reach over $50 trillion by 2025, as reported by SimilarWeb.

1. Long-term Financial Growth

The Harvard Law School has identified the cycle of profitability and sustainability within ESG investing.

As the company has allocated more budget to ESG implementation, it can drive up financial performance as its material ESG risks are under better control. As a result, the company can earn more monetary resources to invest to be an even better-ESG firm and scale up the performance again, which can eventually push up the stock price.

2. More Forward-looking

As the public has increasingly recognised the interdependencies between social, environmental, and economic issues, sustainability is now widely perceived as the new megatrend.

Hence ESG is not only about a company’s existing products and services, but also mirrors its behaviour, conduct, supply chain and other considerations in running the business. Instead of just looking at a company’s historical data, taking its ESG ratings into account allows investors to form a clearer picture of the company’s financial metrics.

Reference: SCMP, Janus Henderson Investor

Types of ESG Standards

ESG covers 3 key aspects, including:

| | Definition | Examples | | Environmental | Conservation of the natural world | * Carbon emission

Air pollution

Deforestation

Water scarcity

| | Social | Consideration of people & relationships | * Working conditions

Employee diversity

Community engagement

Human rights

| | Governance | Standards for running a company | * Lobbying

Political contributions

Internal corruption

Large-scale lawsuits

|

Reference: Investopedia, ADEC Innovations, Nerd Wallet

ESG Investing Trends

The most recent analysis by Bloomberg shows investors planning to spend an estimated $53 trillion by 2025, and the ESG investing is believed to continue to soar as green energy transition remains top-of-mind.

Here are 3 factors fueling the growth of ESG investing, which are:

1. COVID-19 Pandemic

With reference to the BCG survey, people are more concerned about the environmental challenges and devoted to changing their behaviour to advance sustainability due to COVID-19. Moreover, the shift to remote work helps to reduce GHG emissions by 54 million tons, which results in a significant positive impact on the earth.

In other words, the pandemic has raised public awareness of healthcare, and more importantly, the environmental problems.

2. Climate Change

The planet has been sending us some vital warnings in the form of climate changes such as loss of sea ice, accelerated sea-level rise and intensified heatwaves.

Take the Greenland and Antarctic ice sheets as an example, the former has lost an average of 279 billion tons of ice per year between 1993 and 2019, while the latter lost about 148 billion tons of ice per year, as reported by NASA.

As the global climate is projected to continue to change over this century and beyond, it has become the central pillar in ESG investing.

3. Social Unrest

The social factor also plays an important role in accelerating ESG development.

The latest Global Peace Index (GPI) report demonstrated that global peace has declined for a consecutive 9 years since 2021, whereas the protests and civil unrest of all forms have emerged dramatically all over the world in recent years.

Therefore, businesses that can assist in comforting the social discontent via ESG integration can establish greater credibility and reputation among the public.

4. Advanced Data and Technology

Since there have never been generally accepted rules for ESG best practices, its growth has faced various challenges in entering mainstream investment strategies until recent years.

In the age of digital transformation, businesses have become more mature in terms of data capabilities and technology usage. In such a way, businesses can generate valuable ESG data to understand where the future patterns are heading, how to structure the best strategy and what are the most important factors in the coming sustainability journey, which are important indicators to inform decision-making.

Pros & Cons of ESG Investment

Pros:

Create long-term value since ESG is about what happens in the next decade rather than in the next quarter

Avoid activist interventions that are targeting corporates’ social and environmental issues

Boost stock liquidity as both institutional and individual investors are heavily investing in ESG-oriented corporations

Cons:

Not all ESG factors are quantifiable

ESG ratings of different companies follow different methodologies

ESG research might be backwards-looking and fail to capture upcoming changes

Reference: Investopedia

Read more:Introducing Cyber Security and Its Online CoursesWhat is Cryptocurrency? All you need to know about Bitcoin and Blockchain Technology Comparing Virtual Banking to Traditional Banking in Hong Kong

ESG Case Study

1. Microsoft - Striving to Achieve Service and Product Sustainability

As one of the top-rated ESG companies, Microsoft has been carbon neutral across the world since 2012 and commits to being carbon negative by 2030. Not only is it committed to using recycled, recyclable and renewable materials for its electronic products, but it also tries to eliminate as much production waste as possible through the reuse of materials, source reduction and disposal of waste in an environmentally responsible way.Most notably, Microsoft supports responsible shopping from start to finish. It offers a voluntary recycling program for any individual who wants to recycle a Microsoft-branded consumer product and even just the packaging. By collaborating with contracted recycling partners, collection schemes, Microsoft stores, and OEM partners, Microsoft has managed to integrate ESG strategy into the customer experience.

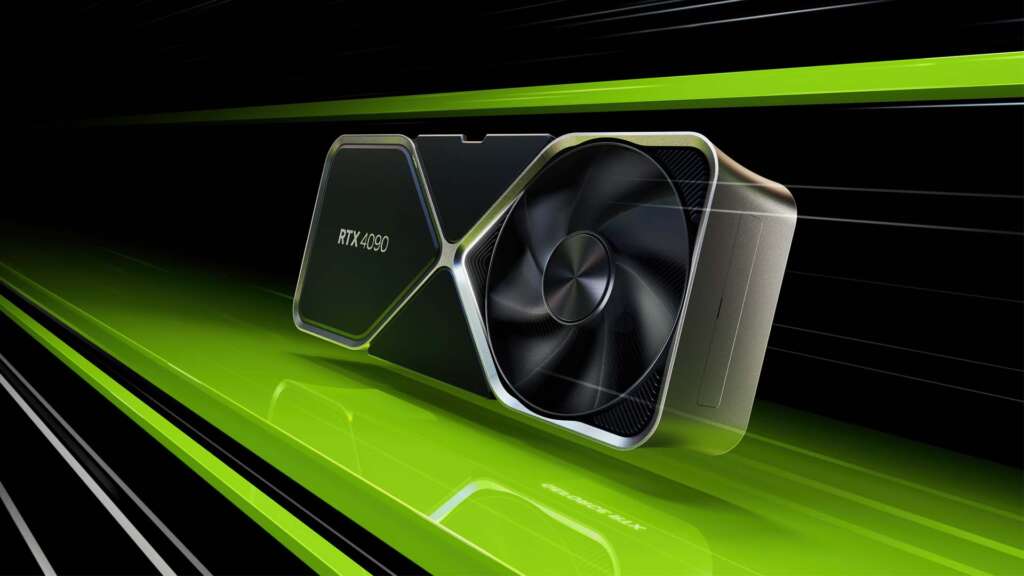

2. NVIDIA - Make People the Top Priority

NVIDIA has put a heavy focus on the “social” element by building a safe, welcoming and inclusive workplace.

To simultaneously align employees’ interests with the stockholders, NVIDIA renders employees’ equity with a realised value that is closely tied to the company stock price performance and vests over time. Nonetheless, to make sure there are no significant disparities in compensation, NVIDIA hires third-party firms to analyse its pay practices for gender, race and ethnicity across over 75 dimensions.

To be more specific, we can take a closer look at its diversity by numbers – 40% of named executive officers are women, while 80% of named executive officers are gender, racially, or ethnically diverse.

3. Best Buy - Develop Outstanding Governance Policies

Acknowledging the depth and breadth of risks relating to ESG issues, Best Buy treats corporate governance practices and structures very seriously. The Board seeks a wide range of experience, skill sets and diverse perspectives, moreover, 10 out of 11 director nominees are independent to provide better support for its long-term strategic goals.

Meanwhile, Best Buy has been actively engaging in political activities and advocating public policy positions that bring positive impact to its business. For example, Best Buy supports the passage of State E-fairness legislation which seeks to improve marketplace fairness.

ESG Examples - Stocks & Funds

Top 5 ESG Stocks as of March 2022

| | ESG Stocks | MSCI ESG Rating | Market Cap (billions) | | 1 | Microsoft (NASDAQ:MSFT) | AAA | $2276 | | 2 | NVIDIA (NASDAQ:NVDA) | AAA | $690.08 | | 3 | Best Buy (NYSE:BBY) | AAA | $21.68 | | 4 | Adobe (NASDAQ:ADBE) | AAA | $203.87 | | 5 | Pool (NASDAQ:POOL) | AA | $17.32 |

The Best ESG Funds as of March 2022

| | ESG Funds | Trailing Return | Expense Ratio | | 1 | Vanguard FTSE Social Index Fund (VFTAX) | 19% (3 years) | 0.14% | | 2 | iShares MSCI USA ESG Select ETF (SUSA) | 15.7% (5 years) | 0.25% | | 3 | Parnassus Core Equity Investor (PRBLX) | 15.6% (5 years) | 0.84% | | 4 | iShares Global Clean Energy ETF (ICLN) | 21.2% (5 years) | 0.42% | | 5 | Shelton Green Alpha Fund (NEXTX) | 22% (5 years) | 1.16% |

Reference: Investors, NerdWallet, Forbes, The Motley Fools

How to start ESG investing?

1. Do Your Own Research

Similar to buying regular stocks, you have to do your homework before investing in an ESG stock.

You can begin with reviewing the company’s ESG reports and other financials. In addition to the above-highlighted stocks and funds, you can also consider other investment opportunities available in the market and evaluate the underlying potential.

Since ESG is quite a vague concept, ESG investing can be purely faith-based. Beliefs differ from person to person, it is hence of utmost importance to take time to carefully identify which of the company’s values resonate with you and which fall outside of what ESG entails.

2. Evaluate with Robo-advisors

Still, the strengths and resources of one single person are limited, that’s why it is suggested to take unbiased advice from the algorithm-driven robo-advisors.

With the help of robo-advisors, you can automate the investment process from start to end by taking advantage of their powerful financial planning, goal setting and tracking tools.

If you are looking for a more personalised investment portfolio, you can even block companies that are not synchronised with your values or other preferences, allowing the robo-advisors to provide you with the best option for accessing and moving money in a seamless way.

3. Seek Financial Advisors

If you are not very familiar with the stock market and don’t want to constantly worry about the performance of your ESG financial products, you might consider hiring financial advisors.

Unlike robo-advisors, the process of consulting a financial advisor greatly depends on human involvement. Your professional financial advisor will first ask you a lot of questions, then synthesise all this initial information into a full-scope financial plan which serves as a roadmap for your financial future.

Upon understanding your fully-customised financial plan, you can be confident in making a sound investment decision as you will be having clearer insight into your current financial situation, liquid capital and net worth.

Reference: Forbes, NerdWallet

FAQ

1. How is the ESG score calculated?

Normally speaking, the ESG score of a company is rated by an authorised third-party agency. However, since different rating providers adopt different methodologies, metrics, data and weightings, the ESG score can vary quite widely. Some of the most renowned ESG rating providers are Bloomberg ESG Data Services, Corporate Knights Global 100, Sustain Alytics ESG Risk Ratings and MSCI ESG Ratings.

Reference: PlantSwitch

2. What is the difference between ESG, CSR and Sustainability?

The concepts of ESG, CSR and Sustainability can be quite confusing. Despite the fact that there are some common grounds, they are not exactly the same:

| CSR(Corporate Social Responsibility) | + | Sustainability | = | ESG(Environmental, Social, Governance) | | * Stakeholder Engagement

Ethics & Justice

Philanthropy

Community

Employees

Wellness

| * Energy & Water Efficiency

Indoor Environmental Quality

Waste Management

Site & Pest Management

Green Cleaning

Purchasing

| * Management & Reporting

Building Performance

Creating Investment Value

Corporate Governance

Resilience

|

Reference: Time Equities Inc

Read more:NFT: What is it? Why is it shaking up the Art World?More than a game: Everything you need to know about MetaverseHow to be a Digital Nomad in 2022? Here are 5 things you need to know